Overview

A recognized industry leader in not-for-profit health care finance, Chapman has been involved in the development of a number of products used in the capital markets today.

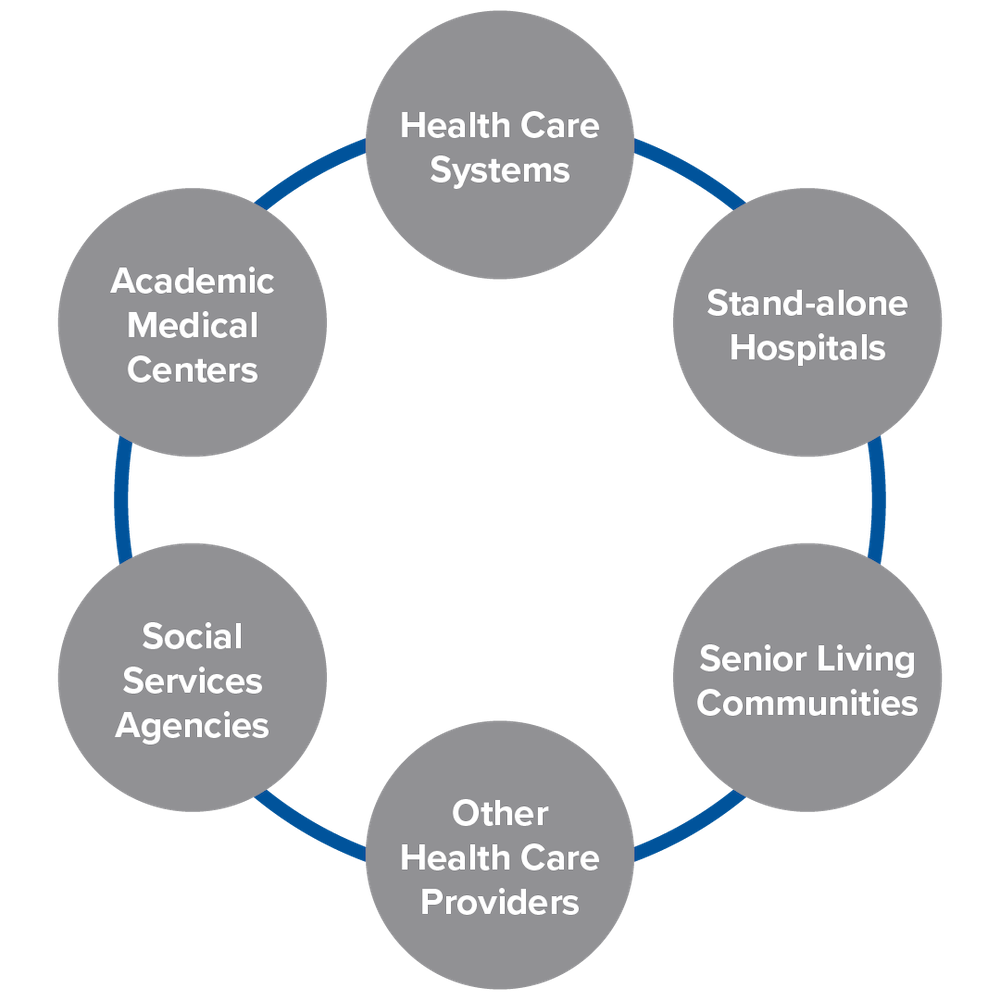

Chapman has one of the largest groups in the nation dedicated to health care finance, with over fifteen attorneys who work primarily with not-for-profit health care institutions and six tax partners dedicated to tax-exempt financing. Chapman regularly serves as bond counsel, underwriter’s counsel, counsel to commercial banks and other credit providers, and corporate counsel in connection with the issuance of tax-exempt and taxable bonds for the benefit of a broad range of health care institutions throughout the United States.

Chapman represents Wall Street investment banks and many of the regional investment banks that serve as underwriters and remarketing agents for health care revenue bonds. In addition, we regularly represent national and regional commercial banks as direct lenders or as credit enhancers for such bonds.

Chapman represents Wall Street investment banks and many of the regional investment banks that serve as underwriters and remarketing agents for health care revenue bonds. In addition, we regularly represent national and regional commercial banks as direct lenders or as credit enhancers for such bonds.

In the last two years, Chapman health care finance attorneys counseled clients in over twenty different states. This national presence gives Chapman attorneys broad exposure to a wide variety of transactions and innovative structures, which we utilize to provide comprehensive advice to our clients.

Chapman attorneys are critical members of finance teams and handle a myriad of issues arising in health care finance transactions, including:

- fixed and multi-modal variable rate structures

- credit enhancement vehicles such as letters of credit, standby bond purchase agreements, and bond insurance

- rated and unrated transactions

- direct purchases and private placements

- commercial paper programs

- mergers, acquisitions, and consolidation of health systems and obligated groups

- master trust indentures

- disposition of assets and remedial actions

- workouts and restructurings

- disclosure issues

- interest rate swaps and derivative products

- tax and securities law issues

- taxable financings

In addition, Chapman attorneys assist clients with post-issuance compliance matters including consulting on disclosure and other SEC matters, responding to IRS requests, and working on submissions to the Voluntary Closing Agreement Program (VCAP) of the IRS. Chapman has been, and continues to be, actively involved in the market commentary on the new rules and regulations promulgated by the SEC and the IRS and works with its clients to develop proper procedures and policies to comply with the requirements of ever-changing federal and state regulations.

Deals of the Year

In recent years, Chapman attorneys have counseled clients on transactions named as Deals of the Year by The Bond Buyer.

CommonSpirit Health. Chapman was counsel to the banks and swap providers on a $6.5 billion financing that was named The Bond Buyer’s 2019 Deal of the Year. The deal involved the merger of Dignity Health and Catholic Health Initiatives into one system, CommonSpirit, which now operates approximately 140 hospitals and health care facilities across 16 states. The financing consisted of both a complex debt restructuring of nearly 50 series of debt and new money reimbursement, generating the largest ever order book for a municipal not-for-profit transaction. Chapman represented each of the banks that provided letters of credit, liquidity facilities, and direct purchase facilities for twenty of the series, as well as a bridge loan. Chapman also represented the swap providers in the related swap amendments.

Owensboro Health. Chapman was bond counsel on a $473 million bond issue for the benefit of Kentucky-based Owensboro Health, which was named the 2017 Southeast Region Deal of the Year by The Bond Buyer. The transaction marked the first use of bond insurance and a surety bond in place of a funded debt service reserve fund by a health care financing since the credit crisis.

Presence Health Network. Chapman was bond counsel for the Illinois Finance Authority’s $1 billion bond issue on behalf of Presence Health Network, which was named the 2016 Healthcare Deal of the Year by The Bond Buyer. As one of the largest high-yield not-for-profit health care bond issues in recent years, the transaction enabled Presence Health to refinance all of its outstanding debt and provided significant interest savings that Presence Health will reinvest in services as part of its turnaround plan.

Vanderbilt University Medical Center. Chapman served as counsel to a bank syndicate that purchased $200 million in bonds in connection with the restructuring of Vanderbilt University Medical Center into a fully independent not-for-profit entity. The complex transaction involved a $1.13 billion financing vehicle involving both taxable and tax-exempt debt and was named the 2016 Southeast Region Deal of the Year by The Bond Buyer.

Adventist Health System/Sunbelt. In 2011, The Bond Buyer named a $1.75 billion credit facility restructuring and related $665 million bond restructuring for Adventist Health System/Sunbelt, headquartered in Florida, as the 2011 Healthcare Deal of the Year. The deal was recognized not only for its size, as one of the largest syndicated bank credit facilities ever structured for a not-for-profit health care organization, but also for its complexity. Chapman served as bond counsel on this transaction, which involved the restructuring of multiple series of bonds through letter of credit replacements, amendments, and remarketings involving fourteen United States and foreign banks.

Innovation and Unique Financings

Chapman attorneys have been leaders in innovations and regularly collaborate with financing teams to improve existing financing products and develop new financing structures in the not-for-profit health care field. Below are some examples of innovations and unique transactions:

- Chapman took the lead role in assisting one of Chicago’s major medical centers and its affiliation partner to combine master indentures. Chapman was instrumental in developing a creative, cost-effective plan and in negotiating with various stakeholders. Chapman frequently assists health systems in integrating multiple obligated groups and combining master indentures in connection with acquisitions, consolidations, and mergers of health care systems and providers.

- Chapman served as borrower’s counsel and disclosure counsel to a world-recognized medical center in connection with its issuance of $400 million taxable “century revenue bonds”—the first “century bonds” (100-year maturity) done for a health care credit in the United States.

- A long history in the growing senior living industry has given Chapman attorneys an understanding of the unique nature of senior living financings. Chapman has served as bond counsel, underwriter’s counsel, and corporate counsel to large multistate systems, regional providers, and single-site communities in financing life plan communities (continuing care retirement communities), as well as nursing homes and assisted living facilities across the country. The Chapman senior living team has worked on numerous financings for new community construction, campus repositionings, renovation projects, refinancings, and debt restructurings.

- Chapman served as special counsel to a world-recognized medical center and assisted in securing the debt financing for an acquisition by its European subsidiary under the medical center’s existing master trust indenture.

- Chapman has served as bond counsel in connection with the creation and restructuring of a tax-exempt accounts receivable securitization program for a multistate health care system.

Related Practices

Derivatives. Chapman has extensive experience representing banks, corporations, insurance companies, and municipal entities in pioneering transactions involving a wide range of derivative products. We represent various health care finance market participants in connection with tender option bond programs, interest rate swaps, total return swaps, and market value swaps.

Social Impact (Pay for Success) Bonds. Chapman is one of the few law firms in the country that has worked on and completed social impact bond transactions (also known as “pay-for-success” transactions). Chapman is exploring the possibilities of using social impact bonds in the health care space.

Leasing. Chapman has a strong municipal leasing practice that handles tax-exempt finance leases for traditional and unique equipment, including medical equipment.

Green Financing. Chapman has experience with the implementation of energy conservation measures and sustainable energy equipment through tax-exempt financings, tax credit obligations, and third-party owner power purchase agreement structures.